1. Swiping for coffee

John has a Visa credit card in his wallet. This credit card has been issued to him by Wells Fargo Bank. He is going to buy coffee at the local Starbucks. Coffee costs $4.00, so John swipes his credit card through the credit card reader.

When John swipes his card, the card reader grabs the credit card number and other information from the magnetic bar and sends that information to the Starbucks Merchant Account (more on this coming up).

Let’s assume that the Starbucks Merchant Account is with the Chase Bank. The card reader sends the card information to the Chase Bank. The Chase Bank forwards that information to the credit card’s issuing bank, which happens to be the Wells Fargo Bank. When Wells Fargo Bank receives this request, it verifies whether John has sufficient funds in his account. Then Wells Fargo Bank sends a response to the Chase Bank stating that the request was approved. Chase Bank, in turn, forwards that response to the card reader. Finally, a receipt is printed for John, who walks away with his coffee and the receipt.

In short, the following things happened when John swiped his card:

Card reader grabs the information from the card.

Card reader sends a request to the Chase Bank.

Chase Bank forwards the request to Wells Fargo Bank via the “Visa interchange and settlement system”.

Chase Bank forwards the request to the Wells Fargo Bank.

Wells Fargo Bank verifies whether John has sufficient funds.

Wells Fargo sends a success response to the Chase Bank.

Chase Bank forwards the success response to the card reader.

All those transactions occurred in less than 3 seconds. Amazing! Right?

2. Buying Online

John is checking out the Amazon.com website, and he wants to buy a book. At the checkout page he enters his credit card information and hits submit.

When he bought his coffee at Starbucks, the card reader read the credit card information, converting it in such a way that the information could be sent to the banking network.

When credit card information is accepted over the Internet, something equivalent of the “card reader” is needed. This will convert the credit card number and other information to a data format that can be sent to the banking network. This is what Gateways do. Popular Gateways are Authorize.net, Braintree and Samurai.

In short, Gateways:

Accept credit card information in a web-friendly manner.

Encode the information and then send it to the merchant bank.

Once the response is received, they decode the response.

They forward the response information to the web application that made the request.

3. Settlement

Previously, we saw that John swiped his credit card and he got a receipt. This means that his credit card was charged $4.00. However, it does not mean that immediately after the transaction, the bank handling Starbucks' account received $4.00. Starbucks does not get John’s money immediately.

In order to get the money, Starbucks has to submit all the transactions done during the day for “settlement” in a batch process. Typically, these batch processes are executed at night. During this settlement process, all transactions done during the day are “settled”. It is during this nightly batch procedure that the $4.00 is credited to the Starbucks account, and $4.00 is charged to John’s credit card.

Until “settlement” occurs, John’s credit card charge is in the “captured” state. “Captured” means that the money was authorized from John’s account, and it is ready for settlement. During settlement, money is sent to the correct recipient.

4. Authorization

Let’s say that John decides to go to Hawaii on vacation. He books his hotel using Expedia.com and he makes the payment using his credit card. He flies to Hawaii and checks into his hotel.

At the registration desk, the clerk asks for his credit card. John says that he has already paid for the hotel. The clerk replies that nothing is going to be charged to the card. Instead, the clerk is only going to “authorize it” for any future purchases. John then hands his credit card to the clerk, who swipes it and hands it back.

What the clerk did is called “authorization”. I will expand on what this means.

John enjoys his vacation, spending a lot of time by the pool. One night, he orders a “pay per view” movie which costs $15. The following morning, he checks out of his hotel and the clerk says John has incurred a bill of $15, so the clerk charges $15 to John’s credit card against the authorization that was done days earlier. This process is called “capturing”.

During the authorization, the hotel wanted to ensure that John had enough credit on his card to pay for incidental expenses like ordering movies, meals, and laundry. Since there is no way to know how much expense John will incur during his stay, the authorization is performed for a reasonable amount. Depending on the type of the hotel this authorization amount might range from $250.00 to $25000.00 or even higher.

The authorization amount guarantees the hotel that the authorized amount is available to the customer in case the customer owes that much amount. Note that no charge has been made to the card at this time.

Also, note that authorization does count towards your limit. Let’s say that John’s credit card has a limit of $1500. If the hotel authorizes his card for $500, then his credit limit is decreased by that amount. Now, if he attempts to buy a flight ticket to London for more than $1000, his credit card will be declined.

Another Example of Authorization and Capture

MissionBicycle is a site where you can build your own custom bike. Let’s say that John wants to buy a bike, and the total cost is $900. John pays $900 for the bike using their online form. The website will immediately authorize John’s card for $900. This means John has enough room on his card to spend $900. Let’s say that it takes one week for the MissionBicycle team to build the bike. Once they have completed the work, they ship the bike to John and “capture” $900 on his credit card.

5. Merchant Account

Mary is good at making stuffed toys. She wants to sell them online and she wants customers to be able to purchase her toys using a credit card. In order to accept credit cards on her website, she needs two things:

A Gateway Account

A Merchant Account

A Gateway account provides a method for encoding all the credit card information, such as the number, CVV code, zip code, address etc. The Gateway forwards all this data to Mary’s merchant account.

The Merchant account is basically where all the money comes at the end of the day when all transactions have been completed.

Usually, a bank provides a merchant account to a business that wants to accept credit cards online. First Data is one of the big players in this market. A financial institution that provides a business with a merchant account is called a “Merchant Account Provider”. Merchant Account Providers are also called “credit card processors”. The Gateway forwards any request to the Merchant Account Provider and they are responsible for processing the swiped or keyed-in credit card. They are also called “Merchant Bank” or “Acquirer”.

A Merchant Account is a pass-through account. This means that the money does not stay in the Merchant Account for long. All the money from credit card transactions comes to the merchant account when settlement is made at the end of the day. Then, the money from the Merchant Account is deposited into the company’s bank account within 24 hours.

Risk

As a business owner, if you request a Merchant Account, the bank will ask you a number of questions about your business. The merchant account holder bank is taking a great amount of risk, so they must make certain you are an honest business person.

Let’s say that on the first day of business, Mary is able to sell 20,000 toys. The toy costs $10. So, at the end of the day, when settlement is done, Mary’s Merchant Account will have $200,000.00 in it. The next day, she takes all this money and disappears without shipping the toys to the customers.

Since the customers did not receive their toys, they will demand a refund from their credit card provider.

The credit card provider companies, in turn, will ask the “Merchant bank” to refund the money. So the “Merchant bank” is at the risk here if Mary is not an honest business person.

This is why banks ask for detailed financial information about the business before a bank agrees to provide them with a “Merchant account”.

In some cases, banks ask for some type of personal collateral also. In some other cases, the merchant bank holds on to the money for a week (or longer) before releasing the money, just in case the product shipped by the business is not of the described quality and the customers start asking for refunds.

This explains why it is very hard to get a “merchant account” for a risky business. In the credit card industry, any business related to gambling, adult entertainment and some aspects of the travel industry is deemed “high risk”. Business owners of these industries need to work extra hard to convince the bank to provide them with a “merchant account”.

6. Credit Card Processor

In order to find the best credit card processor for your company, you need to understand all the components of the pricing structure.

Deception

If you Google “merchant account” or “credit card processor,” you will find numerous businesses offering this service. However, many of those are actually fraudulent. For example, let’s take a look at this advertisement:

The interchange fee imposed by Visa and MasterCard itself is more than 1.1% in most cases. Since a credit card processor has to make money on top of the interchange fee, it is highly unlikely that the fee being charged by this “credit card processor” is a mere 1.05%.

Fee

Let’s say that John bought coffee for the entire office and it cost him $100. He swiped his credit card at Starbucks and paid $100. On the credit card statement, John will see a charge of $100.00.

However, Starbucks will not get the whole $100.00. Depending on what kind of rate is negotiated between Starbucks and John’s merchant account (Chase Bank in this case), Starbucks might have to pay anywhere between 2% to 3% of the transaction amount. Let’s assume that the rate was 2%. That means Starbucks receives $98.00. What happens to the $2.00? That is divided between the bank that issued the credit card to John (Wells Fargo in this case), Visa and the merchant account ( Chase Bank in this case). This $2.00 fee is also called a “merchant discount.”

The credit card issuing bank takes the biggest chunk of the fee. It could be as high as $1.75 of the $2.00 fee. The fee taken by the credit card issuing bank is called an “interchange fee”. It might seem like the “interchange fee” should be dictated by the credit card issuing bank. However, the “interchange fee” is set by Visa or MasterCard and it is non-negotiable. The “interchange fee” is always made up of a flat rate for each transaction plus a percentage of the transaction amount. In the USA, the interchange fee is usually around 1.77% + $0.10 per transaction.

About $0.18 of the $2.00 fee is taken by Visa or MasterCard. This is called “assessments fee”.

The remaining $0.07 is taken by the merchant account provider. This is what is negotiable when a business is looking for a merchant account. The next chapter has more information about how to go about finding the best credit card processor.

How much money a business pays in card processing fees also depends on many other factors. One of the most important factors is whether the transaction type was “card present” or “card not present”. “Card present” is when the card holder physically swipes his card like John did when he bought coffee at Starbucks. “Card not present” is when the card numbers are keyed in either through a telephone or through a website. When John bought a book online, the transaction was called “card not present”.

Since there is more risk of fraud when the card is not present, businesses have to pay more towards credit card processing fees for online transactions compared to their counterparts, where customers swipe their credit cards.

Also, the industry type matters. The fraud rate is generally higher for the travel, gambling and adult entertainment business. The business owners of these types of companies will pay higher credit card processing fees.

Interchange Fee

Interchange fee is the largest portion of the total fee. Both Visa and MasterCard have published a very complex set of rules which dictate the fee conditions and rates. See interchange fee rulebook published by MasterCard and Visa.

Assessments Fee

This is a small fee Visa and MasterCard charge for using their network. Both Visa and MasterCard have set assessments fee to be 0.11% of the transaction amount.

MasterCard charges an additional fee of 0.0185% of the transaction amount. They call it Network and Brand Usage Fee (NABU).

Visa also has an additional fee of 0.0195% of the transaction amount. They call it the Acquirer Processing Fee (APF).

Processor Fee

This is the fee a processor charges for using their services. Usually, they have fees attached to each type of service they offer. Some of the common fees are:

Setup fee (one time)

Monthly maintenance fee

Statement fee

Address Verification (AVS) Fee

Interchange plus

Some credit card processors offer “interchange plus pricing”. What this means is that these credit card processors clearly tell their clients that they will charge whatever the interchange fee is. On top of that, they will charge their processing fee. That is why it is called “interchange plus”. The “plus” stands for the processing fee taken by the credit card processor.

Since all the credit card processors must incur the same “interchange fee”, this model makes it easier to compare rates between one credit card processor and the next. Many credit card processors do not offer “interchange plus pricing” because it is so easy to compare the pricing between two credit card processors.

Business owners who use interchange plus are assured of the markup the credit card processor is earning on each transaction.

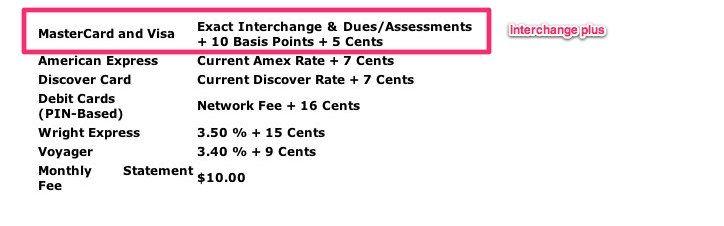

For example, let’s take a look at the website PetroleumMerchant.com. They advertise their rate as

One basis point is equivalent to 0.01%.

Here, the credit card processor is stating that the total fee incurred by the business will be the interchange fee + assessments fee + 0.01% + $0.05 per transaction. The (0.01% + $0.05 per transaction) is the credit card processors' fee.

Another example

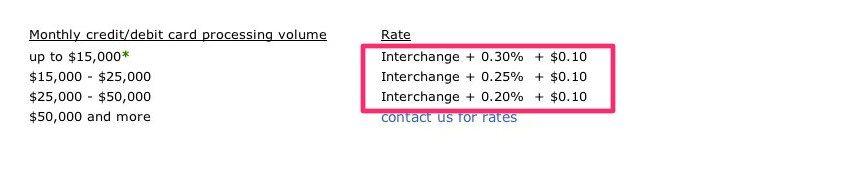

Let’s take a look at the rate offered by Main Street Merchant Solutions.

In this case, the processor’s markup is (0.30% + $0.10 per transaction).

Notice how easy it is to compare the pricing of “Main Street Merchant Solutions” to “Petroleum Merchant”. Petroleum Merchant offers fewer services and hence their pricing is lower.

With “interchange plus”, business owners are able to compare pricing and see what services they are getting.

Tiered pricing

A credit card processor does not want to talk about hundreds of different rates to a business person. To avoid this, they usually place all the various interchange rates into three different buckets.

Qualified discount rate

Mid Qualified discount rate

Non Qualified discount rate

Now the credit card processor only has to talk about three different categories. But here is the catch. In the advertisements, you will see the lowest published rate. While selling the service to you, the credit card processor will always talk about the Qualified Discount Rate.

In reality, when your customers swipe their credit cards, a great many transactions will not qualify for the “Qualified Discount Rate”. What are some of the reasons why transactions will not be charged the lowest bucket rate?

Card not swiped.

Rewards cards - Cards which earn free miles, hotel points etc.

Corporate cards - Cards issued by corporations to their employees.

Customer’s zip code did not match the data on file.

Cards were not settled within the given time frame.

Other factors

By some estimates, around 80% of the transactions do not qualify for the ‘Qualified Discount Rate’.

Braintree

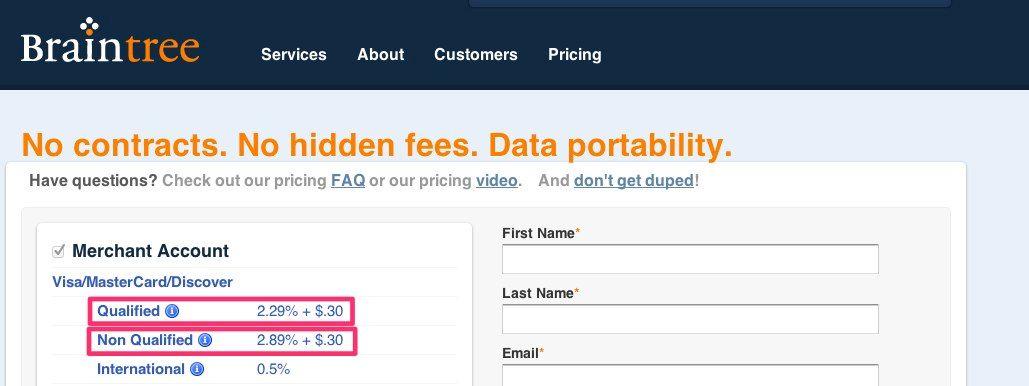

Let’s Take a Look at the Pricing at Braintree

As we can see, Braintree offers two different prices. One rate is for qualified transactions, and another one is for non-qualified transactions.

7. Price Discrimination

Let’s say that you are selling an item for $10. If a customer is trying to pay for that $10 item using a reward card (card that allows card holder to accumulate mileage or hotel points) then the store owner will have to higher interchange fee which can be as high as 3.5% . So in this case the store owner is paying a fee of say $0.35 for selling that $10 item.

A smart store owner might try to tell the customer that hey if you pay using cash then you need to pay only $9.75. Except that store owners were not allowed to do that as per Visa and MasterCard agreements.

In 2010, U.S. Department of justice filed a lawsuit against Visa, MasterCard and American Express citing that restricting the store owners to not to offer lower price is anticompetitive. Visa and MasterCard settled with Department of Justice. However American Express is still fighting the case.

As part of the settlement, store owners who accept Visa and MasterCard can now offer lower rates for the items if paid through a different means (check or cash).

8. Resellers

When you buy a “Honda Accord” car, you do not buy from the company Honda. You buy it from a dealer.

Credit card industry works similarly.

Visa and MasterCard own the network. Processing networks interact with Visa and MasterCard to process credit card transactions. This business is all about the volume of transactions. So, it is hard for a new player to jump into the market and build a credit card processing network. Some of the companies with processing networks are First Data, Chase, TSYS, Global Payments etc.

These credit card processors sell access to their network to resellers. The resellers, in turn, sell the services to others. This is the reason why you find so many companies offering credit card processing services.

9. Chargebacks

Let’s say that John buys a brand new book online. He paid $40 using his credit card. When the book arrived, it was not brand new as was described on the website. It was clearly an older book with pencil markings and torn pages.

John attempts to contact the online seller but gets no response for his emails. But he does have a recourse. He can contact his credit card company and explain what happened, asking for a full refund. This is called a ‘chargeback’.

In a chargeback, the consumer demands that his money be returned.

Banks and credit card companies like Visa, MasterCard and American Express, do not like chargebacks. When a customer initiates a chargeback, the responsible company (the book seller in this case) must pay an extra penalty of anywhere between $15 to $30. Because of this heavy penalty, chargebacks have become highly onerous to businesses.

Sometimes when communicating with the responsible party, the mere threat of a chargeback will cause them to act promptly to resolve the matter.

After a customer has initiated a chargeback, the customer may obtain his refund instantly but this can take a week or more in some cases. In cases where the customer is being unreasonable, a business can show the proper paper work to the credit card issuing bank and thus the business can get their money back from the disgruntled customer.

A customer has 180 days from the date of the transaction to file a request for a refund.

Ready to try Neeto?

Let's get started now.